The digital realm, while convenient, has opened avenues for identity theft risks. With personal data readily available online, cybercriminals possess the tools to perpetrate various forms of fraud, subjecting victims to serious repercussions.

To mitigate these risks, awareness of cybercriminal tactics, vulnerable targets, and risk factors is imperative. This knowledge serves as a crucial defense against identity theft.

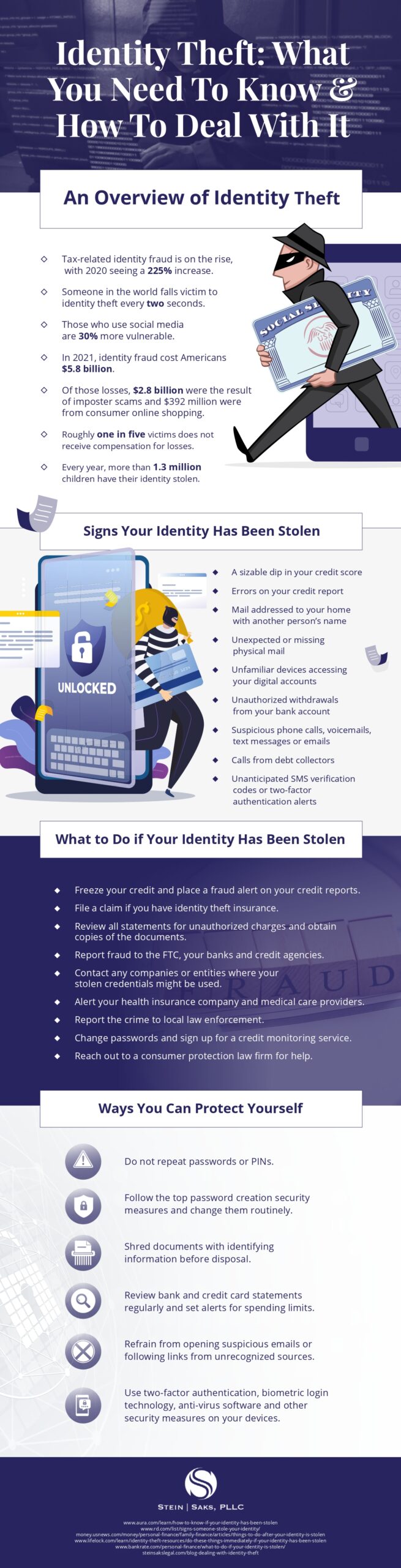

Password security lies at the core of digital safety. Practices such as regularly updating passwords, refraining from using the same password across multiple platforms, and crafting robust passwords incorporating diverse characters are essential habits.

Taking proactive measures such as monitoring financial transactions, activating transaction alerts, and acquiring identity theft insurance can further bolster security protocols. Additionally, safeguarding personal devices and exercising caution with online personal information are vital steps.

In the event of identity theft, immediate actions should include freezing credit, implementing fraud alerts, notifying financial institutions, and contacting law enforcement. Dealing with identity theft aftermath can be daunting, thus seeking assistance from a consumer protection law firm could prove invaluable. They can aid in rectifying credit report inaccuracies, halting creditor harassment, and pursuing damages.

For comprehensive insights on preventing identity theft and managing its aftermath, exploring the provided resource can offer valuable information.

Infographic created by Stein Saks, experts in legally defending against credit reporting errors